From healthcare to finance, the digital revolution has swept through nearly every industry. Banks are more and more taking advantage of cutting-edge technological tools like AI chatbots, gaining a competitive edge and reaching their customer's demands.

DNB, Scandinavia’s biggest bank by market value, turned to boost.ai to manage the high volume of chat traffic to its customer center, developing a virtual banking agent that successfully automated over half of all online chat interactions in just six months.

Indeed, DNB was searching for a comprehensive solution to handle an ever-increasing volume of incoming chat traffic to its website. They needed a way to free up staff from repetitive work while continuing to provide their customers with always-available, 24/7 support.

DNB's results at a glance...

- 2,500 relevant topics covered from day one

- 8 weeks to production-ready virtual agent

- 10,000+ fully-automated daily customer interactions

“The challenge for us has been that we had to use part-time temporary workers to handle the enormous amount of incoming chat traffic” says Øyvind Brekke, EVP & Head of Digital Innovation at DNB. The bank’s considerable market share in its native Norway means that its contact center receives several thousand chat conversations each day, many of which, while easily handled by human agents, still take up valuable time and resources.

Finding the right fit for a big challenge

DNB worked with boost.ai to help develop and launch Aino, an AI chatbot banking agent - powered by conversational AI - with capabilities far superior to those of a typical chatbot. “Artificial intelligence is an important part of our digital strategy,” asserts Jan Thomas Lerstein, SVP & Head of IT Emerging Technologies at DNB. “In leveraging AI, our aim is to revitalize our value chains, creating better service for our customers and, of course, value for the bank.”

Proven business outcomes: 20% of all customer service traffic automated in 6 months | CSAT scores hit all-time high of 68% in Q3 2020

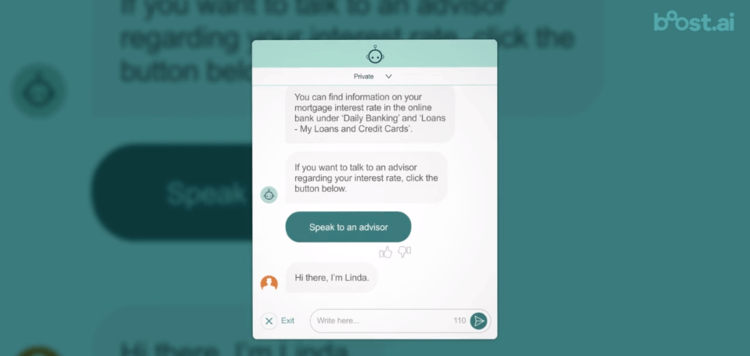

Aino is designed to manage a broad spectrum of inquiries and tasks vital to the bank’s clients daily. It provides information on credit cards and loans, and allows logged-in users to directly interact with their accounts through the chat interface. This greatly expands the virtual agent’s functionality, offering support that goes far beyond basic FAQs.

“The results are a lot higher than we expected”

Since October 2018, DNB has implemented Aino as first-line customer support, routing all customer service traffic to its website through the virtual agent first before customers are able to reach human support. A confident move by the technologically-forward bank that delivered immediate results.

Within just six months, their bank chatbot had begun automating over 50% of all incoming chat traffic and, to date, has interacted with over a million customers. “The results are a lot higher than we expected in such a short time,” says Brekke, adding that the bank “works hard every day to make Aino even better and to find the right balance.”

"Our chatbot AINO is the most efficient employee in DNB."

— Ingjerd Blekeli Spiten, Group Executive Vice President of Personal Banking, DNB

This balance is key to DNB’s strategy for Aino going forward. No artificial intelligence-powered virtual agent can claim to effectively handle every single customer query. Instead, boost.ai’s advanced Natural Language Understanding (NLU) allows Aino to identify what it can and cannot answer, automating thousands of questions daily, and seamlessly routing more complex interactions to its human colleagues when required.

This creates a seamless customer experience where the bank’s clients receive the help they need, whether from a human or AI. It's also a win for support staff, who spend far less time on repetitive questions and can instead focus on more valuable interactions that enhance the bank's service quality.

DNB reports that Aino automates between 50-60% of all incoming chat traffic and ~22% of the bank’s total customer service traffic across all channels. Impressive results that can be attributed to DNB’s ‘chat-first’ approach to customer service automation.

An organization-wide ‘chat-first’ strategy

DNB’s success with Aino has resulted in a steady increase in customer satisfaction, with CSAT scores for the virtual agent hitting all-time highs of 68% in Q3 2020. Lerstein credits this to his team’s work on tracking and measuring customer satisfaction and understanding how it compares across other channels.

“Automated chat has unique qualities that don’t correlate exactly with legacy channels like phone or e-mail,” Lerstein adds. Instead, his team uses analytics tools built into the boost.ai platform to gather customer feedback to help prioritize content and understand what is and isn’t working.

DNB has also applied this ‘chat-first’ approach to internal support, launching a number of virtual agents on boost.ai’s platform to assist employees on everything from HR to legal issues.

“Our customers prefer using Aino over picking up the phone or waiting in line for live chat.”

— Jan Thomas Lerstein, SVP & Head of IT Emerging Technologies, DNB

The most impressive by far is Juno, an advisory bot for customer service and retail banking employees designed to increase productivity by replacing cumbersome employee manuals with a friendly, conversational interface that makes finding information easier. Juno has over 5,000 daily users and is popular amongst employees thanks to consistently high accuracy rates of 80%.

In 2021, DNB plans to expand its total of AI chatbots to five, with a new internal service desk virtual agent that Lerstein says will “focus from day one on assisting with password resets, generating service tickets and human agent handover.”

The right balance between human and machine

DNB has not only revolutionized how it interacts with its customers but has also opened up new opportunities for employees. Today, the bank has 15 full-time AI Trainers working across its suite of virtual agents. Dedicated to training each bot how to best respond to customers and employees, this unique role offers existing staff the chance to combine their customer service expertise with substantial knowledge of the bank’s products and a technical understanding of how conversational AI works.

“Their job is simple,” says Carla Padro, Senior IT Project Manager for the team responsible for Aino “To make Aino and our other virtual agents the most efficient employees in the customer center.” Each AI Trainer is certified on boost.ai’s no-code platform, requiring no prior technical experience, meaning the bank can avoid spending money and resources on costly data scientists and developers to maintain its virtual agents.

“This has gone much faster than we thought - this is a mature technology that is clearly ready to be used.”

— Ingjerd Blekeli Spiten, Group Executive Vice President of Personal Banking, DNB

Moving forward, DNB plans to enhance the capabilities of its virtual agents, expanding the variety of tasks they can handle and further customizing the chat experience for its customers. “We will continue to push the boundaries of what can be achieved with conversational AI,” states Lerstein, who keenly recognizes the importance of finding the right equilibrium between human and machine interaction to fully realize the potential of digital banking.

“In improving efficiency, the sky’s the limit,” he adds, optimistically. And, with the Nordic banking market already boasting over 90 percent of customers regularly banking online, it makes DNB’s decision to offer frictionless digital banking support via Aino and its chatbot family a decidedly savvy one.

Thanks to its AI chatbot and dedicated team of AI trainers, DNB kept automating its incoming chat traffic over the last year, reaching 55% of all chat (20% of all customer service requests across all channels including phone and email)in 2021.

A model for the financial industry

Since 2018, AI chatbot banking has rapidly grown within the financial industry.

By 2023, major financial institutions from all around the world are expected to use AI chatbots features to facilitate requests and inquiries more quickly and conveniently than ever before. Bots are anticipated to become a key tool for banks, providing a seamless and secure system for customers to speak directly with a bank representative or automated virtual assistant.

Using natural language processing (NLP), AI chatbot banking solutions provide a whole new way for banks to communicate with customers in a cost-effective manner, paving the way for a revolutionised era of customer service.

Learn more about AI chatbot banking with our latest free chatbot banking guide.