Sparebank 1 SR-Bank used conversational AI as a creative method of helping to alleviate financial hardship for its customers during the height of the pandemic

When the COVID-19 pandemic hit in the spring of 2020, the Norwegian economy was impacted as heavily as its counterparts in the rest of Europe and abroad. A nation-wide lockdown and a plummeting currency led to high rates of unemployment (peaking at 9.4% in April) and prolonged furloughs that, understandably, left many Norwegians worried about the future.

Like many other industries, Norway’s banks and financial institutions saw dramatic spikes in customer service traffic as concerned citizens called, emailed and engaged online chat channels to inquire about the state of their finances. This almost-overnight need for a scalable customer service solution meant that the country’s banks were required to think creatively about how they could manage overwhelming traffic volumes while still being able to provide a high standard of service.

As a financial services provider, Sparebank 1 SR-Bank recognized quickly that it needed to ensure a smooth transition to a digital banking experience for its customers during the Covid-19 pandemic. To maximize customer protection and service, the bank invested in AI mortgage solutions to help guide their customers through a challenging period. As a result, SR-Bank was able to provide essential services and greater choice with a secure online platform for each of their customers. In such difficult times, investing in AI solutions enabled the bank to meet customer demand as well as ensure a secure environment for both its employees and customers alike.

SR Bank's results at a glance...

- Automated mortgage payment deferment (up to 12 months)

- Conversational AI and RPA integration

- 3 weeks from idea conception to launch

“We put ourselves in the shoes of our customers and asked what is it that keeps them awake at night?” said Ramtin Matin, Lead Technological Strategist at Sparebank 1 SR-Bank. “One of the primary concerns that we kept coming back to was how could we help a customer that may struggle to meet their monthly mortgage payments?”

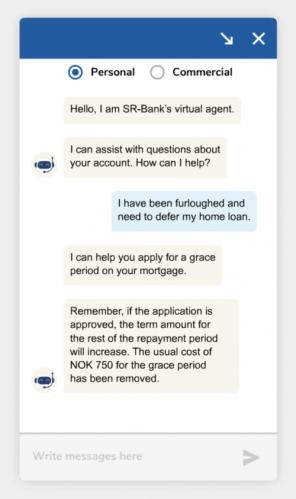

With over 300,000 private and business customers across the country, SR-Bank is one of Norway’s pioneering digital-first banking institutions. Back in 2016, it was among the first banks in Europe to launch a conversational AI-powered virtual agent that has since become the centerpiece of its digital customer service strategy. The virtual agent, developed on boost.ai’s conversational AI platform, acts as the primary customer contact point for SR-Bank. All service and support communication goes through this channel with it successfully automating 49,5% of the bank’s total customer service traffic and increasing support capacity by 195%.

“We realized that the answer was right in front of us,” adds Matin. “Instead of requiring customers to contact us by phone, we could use the virtual agent to speed up the process of deferring mortgage payments.” Part of SR-Banks’s plan to offer financial relief to customers adversely affected by the pandemic included the ability to apply for a deferment of mortgage payments by up to 12 months.

This unique solution required SR-Bank’s conversational AI platform to interface with existing Robotic Process Automation (RPA) systems to create a seamless experience. The virtual agent, using boost.ai’s proprietary Natural Language Understanding (NLU), provided a conversational front-end, where customers could fill out the application process in real-time while the RPA systems worked in the background to assess credit risk and eligibility. This resulted in customers getting an immediate response, without needing to speak with a human service representative at any stage of the process.

“In terms of relationship strategy, I think we achieved something really meaningful,” said Matin. “By empowering customer self-service with the virtual agent, we helped lighten the burden that they may have experienced in a potentially insecure situation.”

Thanks to the flexibility of boost.ai’s conversational AI platform, the mortgage-deferment integration took only three weeks from the time Matin’s team conceived of the idea in March 2020 until it was rolled out to customers. SR-Bank’s AI Trainers, whose job it is to train and maintain the virtual agent so that it is always up-to-date, prioritized the project so that they could get out ahead of an expected uptick in requests for mortgage deferment applications in the early days of the pandemic.

At its peak, SR-Bank was receiving upwards of 300 inquiries per day related to mortgage payment deferment, making the virtual agent a key channel for helping to help mitigate the workload placed on the bank’s contact center. This AI mortgage solution allowed for a more efficient customer service experience for those needing assistance, by taking a complex situation and making it easier to navigate at a quicker rate.

“Being able to utilize this kind of technology in a time of crisis both helped our customer service department do a better job and also helped customers get a swift response,” concluded Matin who strongly believes that it would not have been possible for SR-Bank to effectively manage the increase in inquiries without a virtual agent in place. “When it comes to these types of transactional use cases, having this type of functionality in place is extremely valuable.”